Tax Record For Property

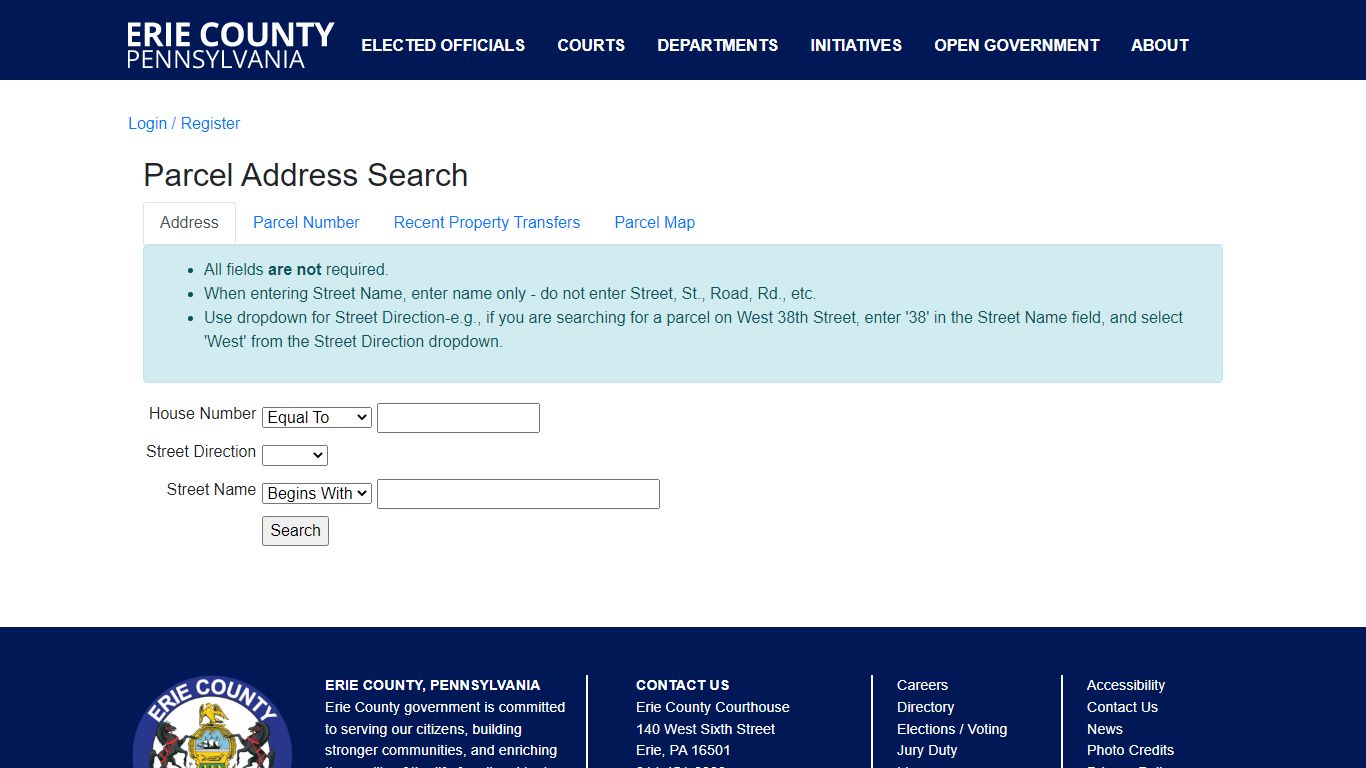

property and tax records search - Erie County, Pennsylvania

property and tax records search Parcel Address Search Address Parcel Number Recent Property Transfers Parcel Map All fields are not required. When entering Street Name, enter name only - do not enter Street, St., Road, Rd., etc.

https://public.eriecountypa.gov/property-tax-records/property-records/property-tax-search.aspx

Property Taxes - New York City

Online Tools. Property Tax Bills & Payments. Data and Lot Information. Exemptions & Abatement Lookup. Assessed Value History by Email. Find Property Borough, Block and Lot (BBL) Payment History Search. Digital Tax Maps. Property Refund Request.

https://www1.nyc.gov/site/finance/taxes/property.page

Property Tax | Galveston County, TX

Call the Property Tax Department (409) 766-2481 for additional information. Payment Methods & Options Click on the large red button and pay online via electronic check, debit or credit card (fees apply). You will be able to print a receipt upon payment but files are not received by our office until the following business day for review.

https://www.galvestoncountytx.gov/our-county/tax-assessor-collector/property-tax

how to check the tax record of the property - HAR.com

There are several ways to see the property in the tax rolls! * In Matrix click the TAX tab at the top of the page and look under Realist Tax or Matrix Tax * When you pull up a home on Matrix there is a link "Tax Account #" pretty close to the address on the full printout. * Of course visit the county appraisal district.

https://www.har.com/question/6406_how-to-check-the-tax-record-of-the-property

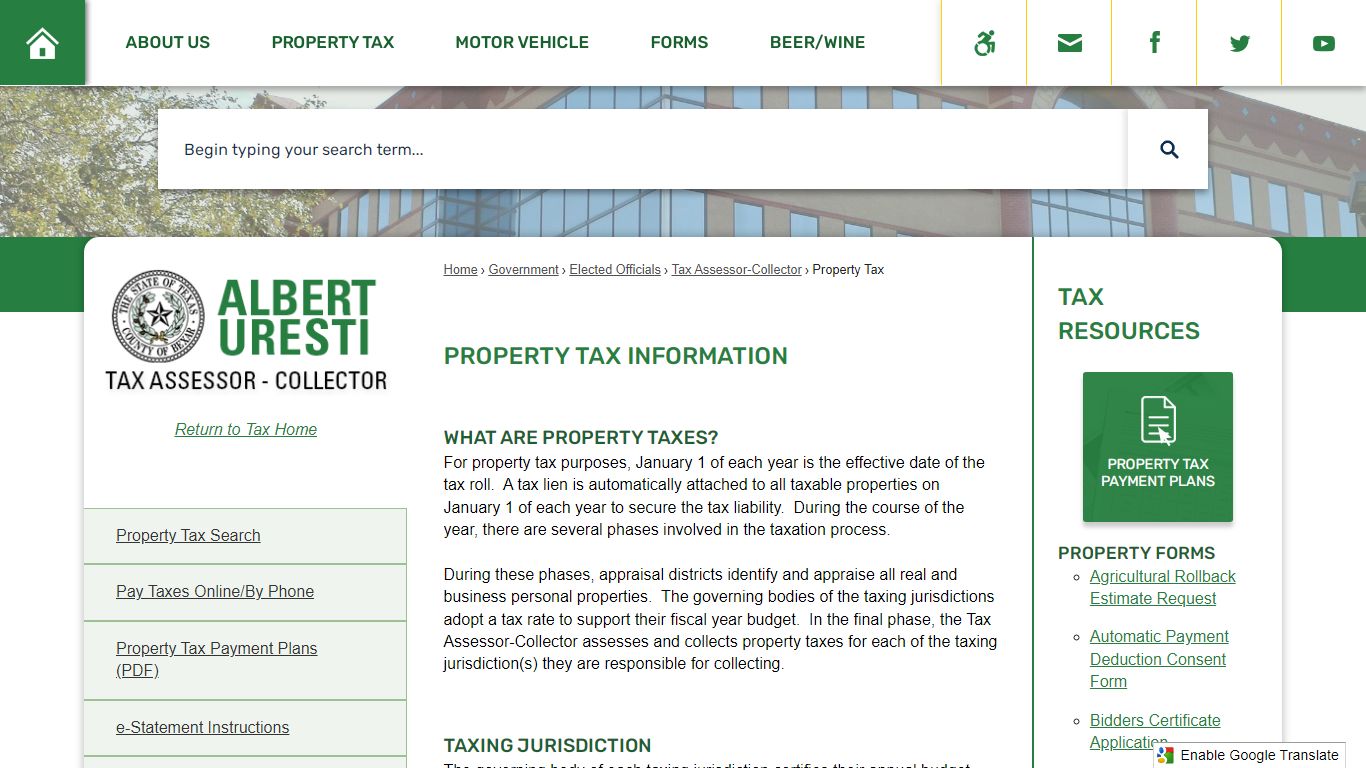

Property Tax Information | Bexar County, TX - Official Website

Pursuant with the Texas Property Tax Code, properties are taxed according to their fair market value. For example, the tax on a property appraised at $10,000 will be ten times greater than a property valued at $1,000. In the event a property owner disagrees with their assessed value, a protest may be filed with their appraisal district.

https://www.bexar.org/1529/Property-Tax

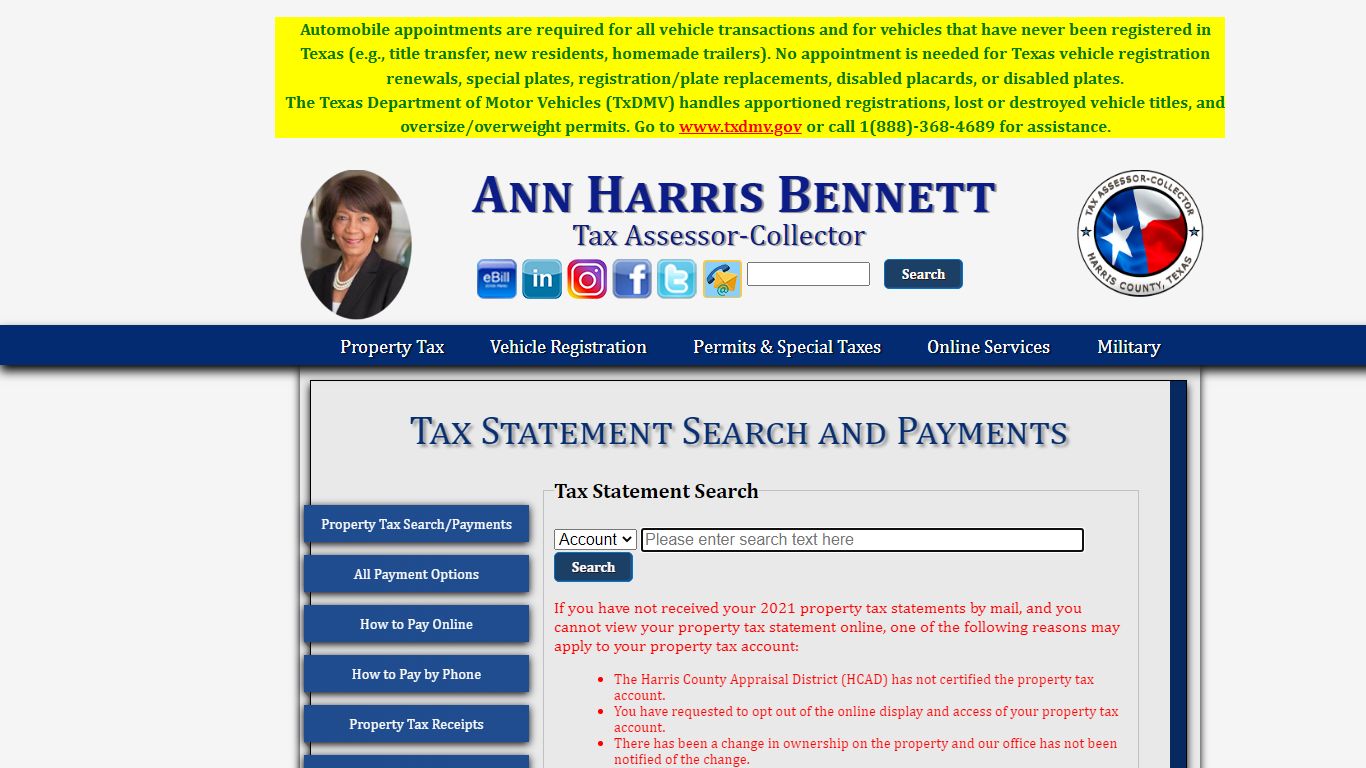

Property Tax Receipts - Harris County Tax Office

For an official record of the account, please visit any Tax Office location or contact our office at 713-274-8000. If you currently owe property tax on your account but your account information does not display, the values may not yet have been certified by the appraisal district.

https://www.hctax.net/Property/PropertyTax

Real Property Records - Clark County, Nevada

Home Government Assessor Real Property Property Search Real Property Records. Search by one of the following: Parcel Number. Owner Name. Address. Subdivision Name. Subdivision Owners. Parcel Type/Book & Page. Parcel Number Tree.

https://www.clarkcountynv.gov/government/assessor/property_search/real_property_records.php

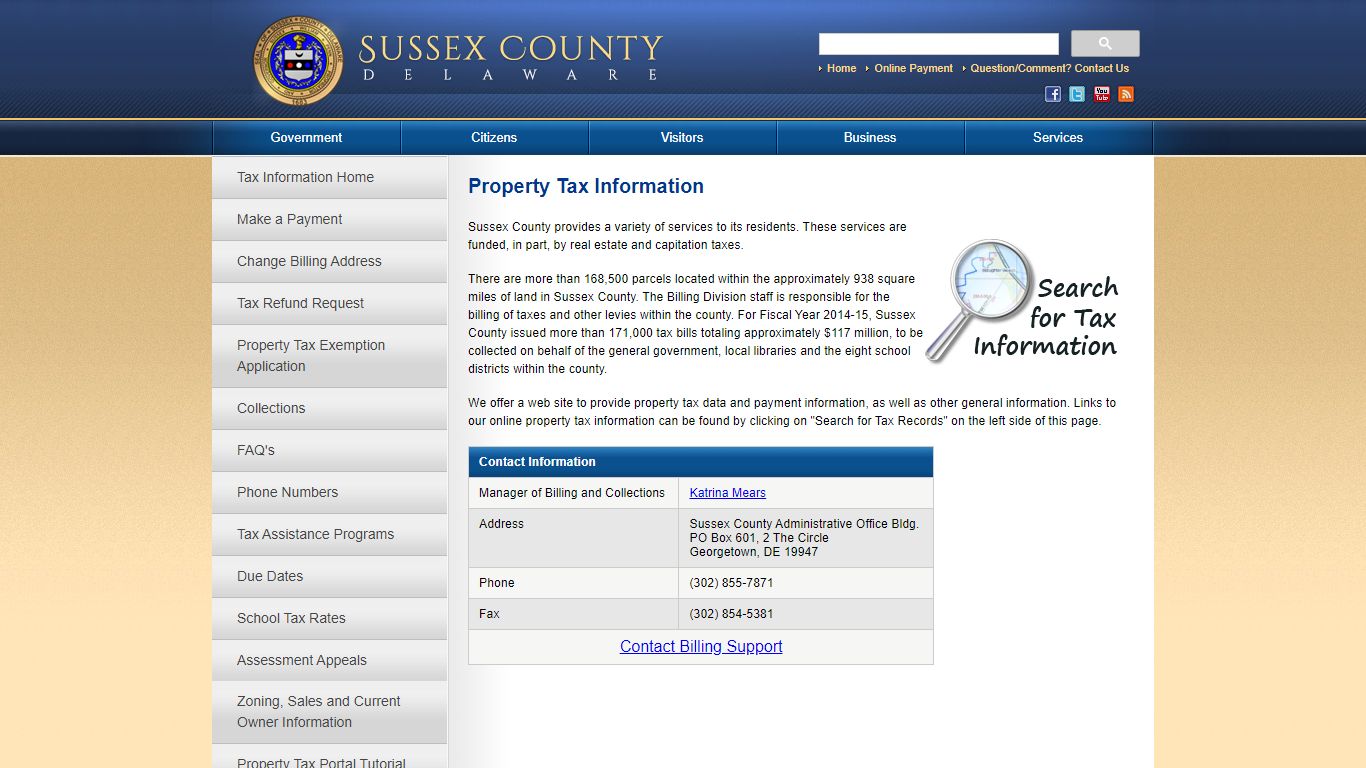

Property Tax Information | Sussex County

Links to our online property tax information can be found by clicking on "Search for Tax Records" on the left side of this page. Contact Information. Manager of Billing and Collections. Katrina Mears. Address. Sussex County Administrative Office Bldg. PO Box 601, 2 The Circle. Georgetown, DE 19947. Phone.

https://sussexcountyde.gov/property-tax-information

Property Tax - Tax Collector of Escambia County

Scott Lunsford Tax Collector Escambia County, Florida. A-Z. Check us out on Facebook. Keep up to date with us on Twitter. About Scott Lunsford. Home. Payment Center Pay or search records online. Join the Line Click the “What Do I Bring” button below to ensure correct documentation. Appointment Scheduler.

https://escambiataxcollector.com/property-tax/

Tax Assessor-Collector - collincountytx.gov

Property Taxes. It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county. Avoid Penalties! Pay property taxes on time. Property Tax Statements are mailed out in October, and are due upon receipt. To avoid penalties pay your taxes by January 31, 2022.

https://www.collincountytx.gov/tax_assessor/Pages/property.aspx

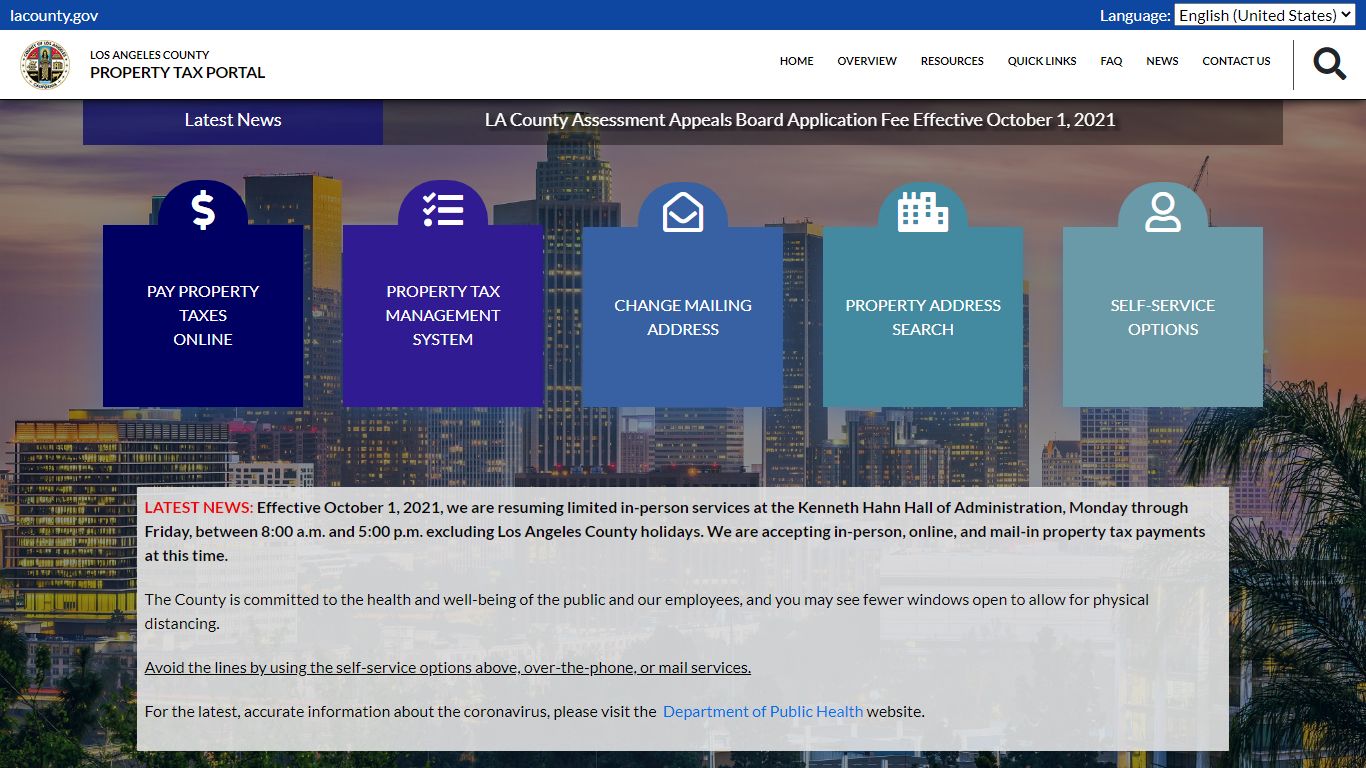

Los Angeles County - Property Tax Portal

Assessor, Auditor-Controller, Treasurer and Tax Collector, and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. Jeffrey Prang Assessor

https://www.propertytax.lacounty.gov/